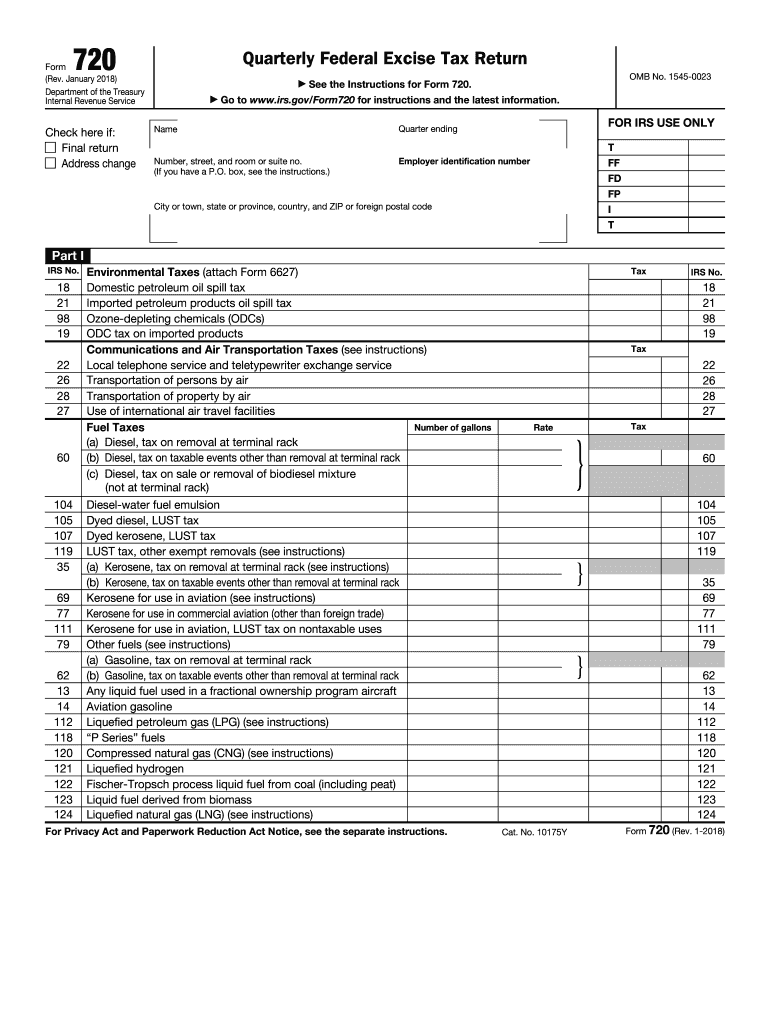

Pcori Fee 2025 Form 720. How much is the form 720 pcori fee? These fees are due each year by july.

Irs releases updated pcori fee amounts for 2025. It is required to be reported only once a year in july.

How to complete IRS Form 720 for the PatientCentered Research, Pcori fees are reported and paid annually on irs form 720 (quarterly federal excise tax return). Submit pcori payment via irs form 720 for 2025 plan year by july 31, 2025.

Compliance Reminder PCORI Fee Notice Brinson Benefits Employee, Irs form 720 is used to file and pay for this charge annually. The amount for calculating the pcori fee is $3.22 per.

Form 720 and PCORI fee FAQs, The pcori fee is filed and paid annually on irs form 720 (quarterly federal excise tax return). Pcori fees are reported and paid annually on irs form 720 (quarterly federal excise tax return).

What are PCORI Fees? IRS Tax Year 2025 The Boom Post, 1, 2025, and before oct. The pcori fee is filed and paid annually on irs form 720 (quarterly federal excise tax return).

How to complete IRS Form 720 for the PatientCentered Research, These fees are due each year by july. The pcori fee is due july 31, 2025.

PCORI fee Form 720 available now, Pcori fees are reported and paid annually on irs form 720 (quarterly federal excise tax return). It is required to be reported only once a year in july.

How to complete IRS Form 720 for the PatientCentered Research, These fees are due each year by july. The pcori fee is filed and paid annually on irs form 720 (quarterly federal excise tax return).

Irs form 720 Fill out & sign online DocHub, These fees are due each year by july 31 of the year. In 2025, the irs will issue an updated form 720 for the second quarter with the pcori fees adjusted for the upcoming july 31 payment date.

PCORI Fees Special Counting Rules for HRAs, The amount for calculating the pcori fee is $3.22 per. It is reported on irs form 720.*.

PCORI Fees Now Due August 2, 2025 Instead of July 31. MyHRConcierge, The pcori fee is due july 31, 2025. Employer will file the first form 720 to pay the pcori fee of $3.00 per covered life july 2025.

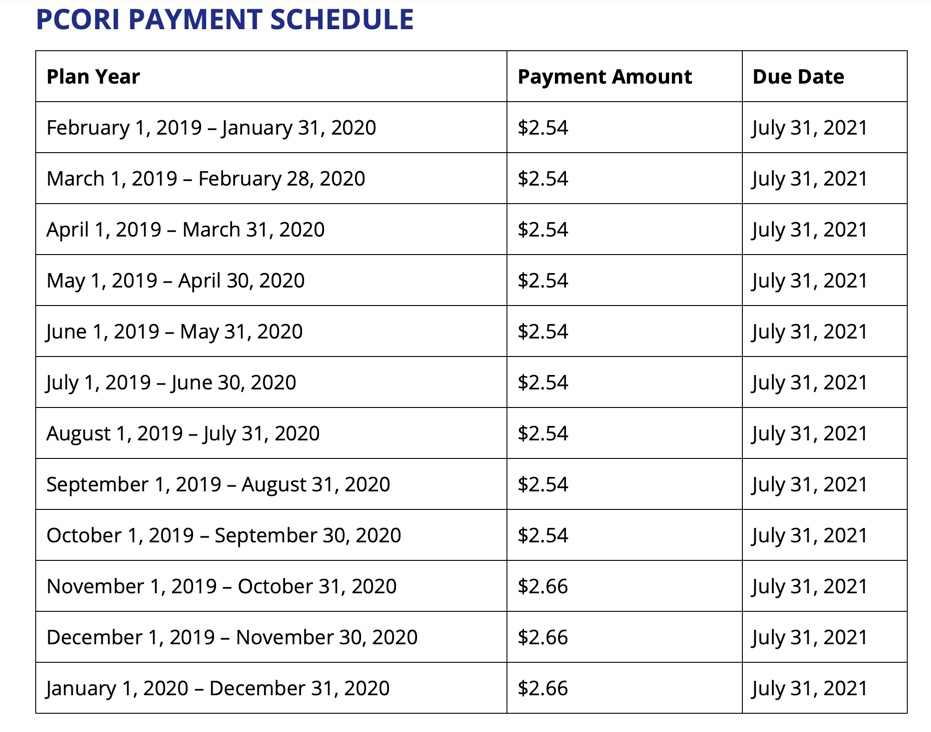

The payment amounts due in 2025 vary based on the employer’s plan year, specifically the plan year’s end date.