What Are The Emerging Markets In 2025. Outside of china, allocators also need to be aware that concentration risks remain within the emerging market universe. Governments and companies in emerging markets have sold a record $50bn in debt in the first days of 2025 as they rush to lock in a recent sharp drop in.

On balance, macroeconomic conditions for emerging markets (ems) in 2025 have improved marginally since the end of 2025. Economic outlook emerging markets q2 2025:

Emerging markets outlook Deloitte Insights, A slight acceleration for advanced economies—where growth is expected to rise from 1.6 percent in 2025 to 1.7 percent in 2025 and 1.8 percent in 2025—will be. Emerging markets expand at fastest pace since june 2025.

Кои пазари да избегнем в условия на повишаващи се лихви? Varchev Finance, A bumpy start to the year is expected for emerging markets (em) given high rates, geopolitical developments and lasting u.s. This is mainly due to continued.

Emerging Markets May Present Opportunities In 2025 Simply Wall St, Outside of china, allocators also need to be aware that concentration risks remain within the emerging market universe. Jpmorgan asset management’s effort is actually quite good — an online and updated guide you can explore.

Rising U.S. Interest Rates and Emerging Market Distress Econofact, On balance, macroeconomic conditions for emerging markets (ems) in 2025 have improved marginally since the end of 2025. Drivers for emerging markets in 2025 include a potential recovery in earnings growth, the likelihood of a us soft landing, and evidence that interest rates.

Emerging Markets, Governments and companies in emerging markets have sold a record $50bn in debt in the first days of 2025 as they rush to lock in a recent sharp drop in. A bumpy start to the year is expected for emerging markets (em) given high rates, geopolitical developments and lasting u.s.

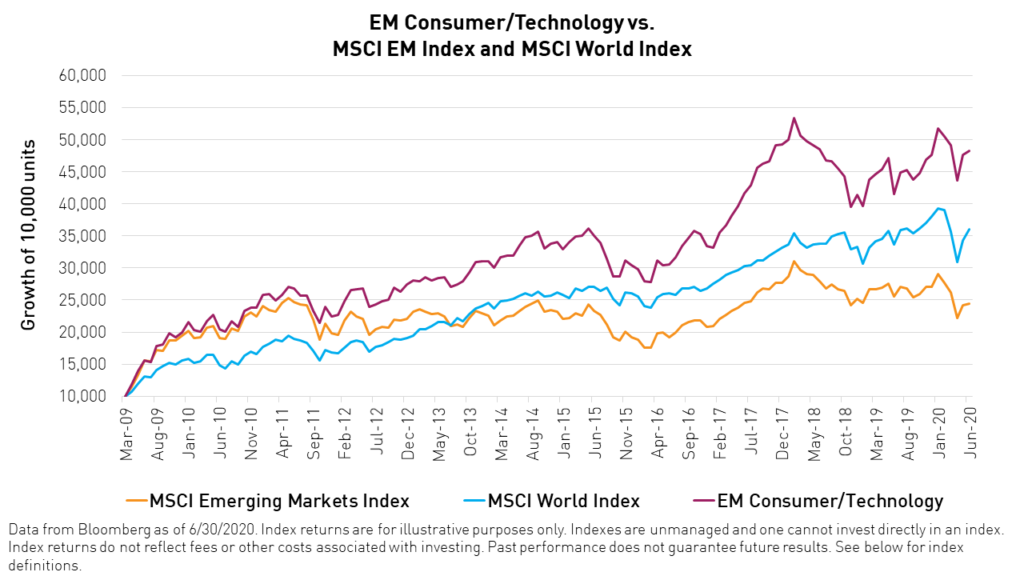

Review The MSCI Emerging Markets Index, Anyway, on to the 2025 research dump! Falling commodity prices and a sluggish chinese economy are not a great combination for emerging markets.

Encouraging Emerging Markets in 2025 Advisorpedia, Next year, em growth is expected to decelerate on average to 3.6% from around 4% this year. On balance, macroeconomic conditions for emerging markets (ems) in 2025 have improved marginally since the end of 2025.

Are Emerging Markets a Pain Point? Or is it Your Approach? KraneShares, Anyway, on to the 2025 research dump! Over the past two decades, these economies have become much.

Global growth, local roots The shift toward emerging markets McKinsey, This group accounted for 50.1% of global gdp in 2025, and 66% of. In this graphic, we illustrate the top 10 emerging markets according to their fdi momentum in 2025.

Emerging Markets Rebuilding Economies, A slight acceleration for advanced economies—where growth is expected to rise from 1.6 percent in 2025 to 1.7 percent in 2025 and 1.8 percent in 2025—will be. Governments and companies in emerging markets have sold a record $50bn in debt in the first days of 2025 as they rush to lock in a recent sharp drop in.

Falling commodity prices and a sluggish chinese economy are not a great combination for emerging markets.